Car Tax Changes 2018: The New VED Road Tax Guide

15th Feb 2018

So, if you're still none the wiser when it comes to car tax, and the car tax changes, allow us to recap, as well as guide you through the new changes - which will affect buyers of diesel cars from April 1st 2018.

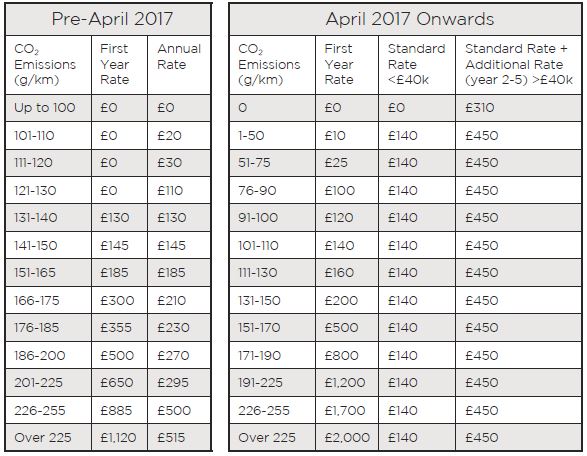

Before April 2017 - If your car was registered before 1st April 2017, you will continue to pay the 'old rate' of vehicle tax you have been paying previously.

1st April 2017 - The government introduced new rules regarding VED - which affected anyone buying a brand-new car. This included a first-year fee decided by the car's CO2 band. Only electric and zero-emissions car owners could take advantage of paying £0 vehicle tax.

November 2017 - In somewhat of a U-turn, the government announced that new diesel vehicles which did not meet real driving emissions (RDE) standards would be charged more in tax from April 2018.

This means that some diesel vehicles, especially cars with a high capacity engine (which produce more CO2 emissions), could see quite a substantial rise in their first-year tax cost - increasing their VED rates.

For example, a car emitting 110 g/km of CO2 would have paid £140 in the first year, but under the new regulations this rises to £160, if it doesn't meet Euro 6 RDE regulations.

However, a vehicle with a larger engine, emitting 195 g/km of CO2, would have a first year VED rate of £1,200, but if it does not meet Euro 6 RDE standards the fee would rise to £1,700.

In both examples, if the vehicle has a manufacturer RRP of £40,000 or more, then the second year would return to the standard £140 flat rate, plus the £310 supplement.

First year VED rates are included in all manufacturer "on-the-road" prices.

What are Euro 6 Real Driving Emissions?

At the end of last year, a new "real driving emission" test was introduced to rate cars on their actual real-world emissions compared to their laboratory emissions. The test involves the car being driven by a real person on real roads while special equipment measures whether the car is exceeding pollution limits. The limit for Nitrous Oxide (NOx) in the laboratory test is 80mg/km, but for the real-world test cars can pollute up to 1.5 times the limit to remain compliant. It is cars that do not meet this standard - currently the vast majority on the road - that will be subject to the increased VED band fees.

How do I know what cars are affected?

Affected cars vary greatly by manufacturer. Some will face first year road tax increases of just £20, while others could be up to £500. Please contact your local Stratstone retailer to find out more.

Summary

If you are familiar with the new 2017 rules, and own a petrol vehicle, nothing has changed. However, buy a new diesel vehicle after 1st April 2018 this could affect you, depending on your chosen new vehicle.

Discerning buyers who want to save money on increased road tax will stand to benefit financially from making any prospective new vehicle purchase before 1st April 2018 - before the new rules come into force. Tax bands for 2017 and for the new 2018 tax brackets 'UK' are shown below.

|

CO2 Emissions (g/km of CO2) |

2017 First Year Rate |

1st April 2018 First Year Rate Not meeting Euro 6 Standards |

|

0 |

£0 |

£0 |

|

1 - 50 |

£10 |

£25 |

|

51 - 75 |

£25 |

£100 |

|

76 - 90 |

£100 |

£120 |

|

91 - 100 |

£120 |

£140 |

|

101 - 110 |

£140 |

£160 |

|

111 - 130 |

£160 |

£200 |

|

131 - 150 |

£200 |

£500 |

|

151 - 170 |

£500 |

£800 |

|

171 - 190 |

£800 |

£1,200 |

|

191 - 225 |

£1,200 |

£1,700 |

|

226 - 255 |

£1,700 |

£2,000 |

|

Over 255 |

£2,000 |

TBA |

Car Tax Changes 2017

Published on 13th FEB 2017

By purchasing a new vehicle before 1st April 2017 you can avoid the road tax increase.

As of April 1st 2017, the way in which Vehicle Excise Duty (VED) is calculated will be changing.

VED - sometimes known as road tax - is administered by the DVLA and is the annual tax on the ownership of most road vehicles. This is a duty which has to be paid in order for vehicles to be used or parked on public roads.

Currently the way in which VED rates are calculated is based on the engine size, or fuel type and CO2 emissions depending on the registration date of the vehicle. Once these changes come into practice, the new tax rates will not affect vehicles already registered before April 1st 2017, which is good news if you're looking to buy a used or new car for delivery before that date, as you won't be affected by increased charges.

Vehicles registered on and after April 1st 2017 will be taxed on a first-year rate which is based on the CO2 emission band applicable to the car and they will also incur a standard fee of £140 in the following years.

In addition to this, any vehicle with a list price over £40,000 will incur an additional charge of £310 per annum for the next five years. This means that vehicles registered from 1st April 2017 with a list price over £40,000 will pay £450 for the next five years, after which they will revert to the standard rate of £140 per year for year six and onwards.

So, how will this affect you?

If you are buying a vehicle that is registered on or after April 1st 2017, you will be charged based on the CO2 emissions bandings applicable to that vehicle. The second year and thereafter, the standard rate of £140 per year will apply unless the list price was over £40,000. The table below shows the differences in charges in detail.

The list price refers to the manufacturer's recommended retail price, not the price paid for the vehicle, including any additional extras fitted. Going forward the new scheme will follow a three-tier system classifying which tax rates will apply to which vehicles.

1: Zero emission vehicles under £40,000 are exempt from the new tax.

2: Petrol and diesel engines with a list price of up to £40,000 that emit 1g/km CO2 and above, will be charged a VED rate of £140 from its second registered year.

3: Petrol and diesel engines with a list price of £40,000 and above, including zero emission vehicles, will be charged a VED rate of £450 from its second registered year. After 5 years of being registered, this tax amount will revert and decrease to £140.

The new tax will not apply to vehicles registered before April 1st 2017, nor will it apply to commercial vehicles, HGVs and motorbikes.

The table below shows the standard rate of vehicle tax for cars registered after and 1st March 2001 and the VED tax bands from April 2017 onwards.

Beat the rising road tax and act now.

More from Stratstone

News

See the latest news from the world of Stratstone and premium cars.

Stratstone Social

Share your pictures with us